2024 Office real estate report

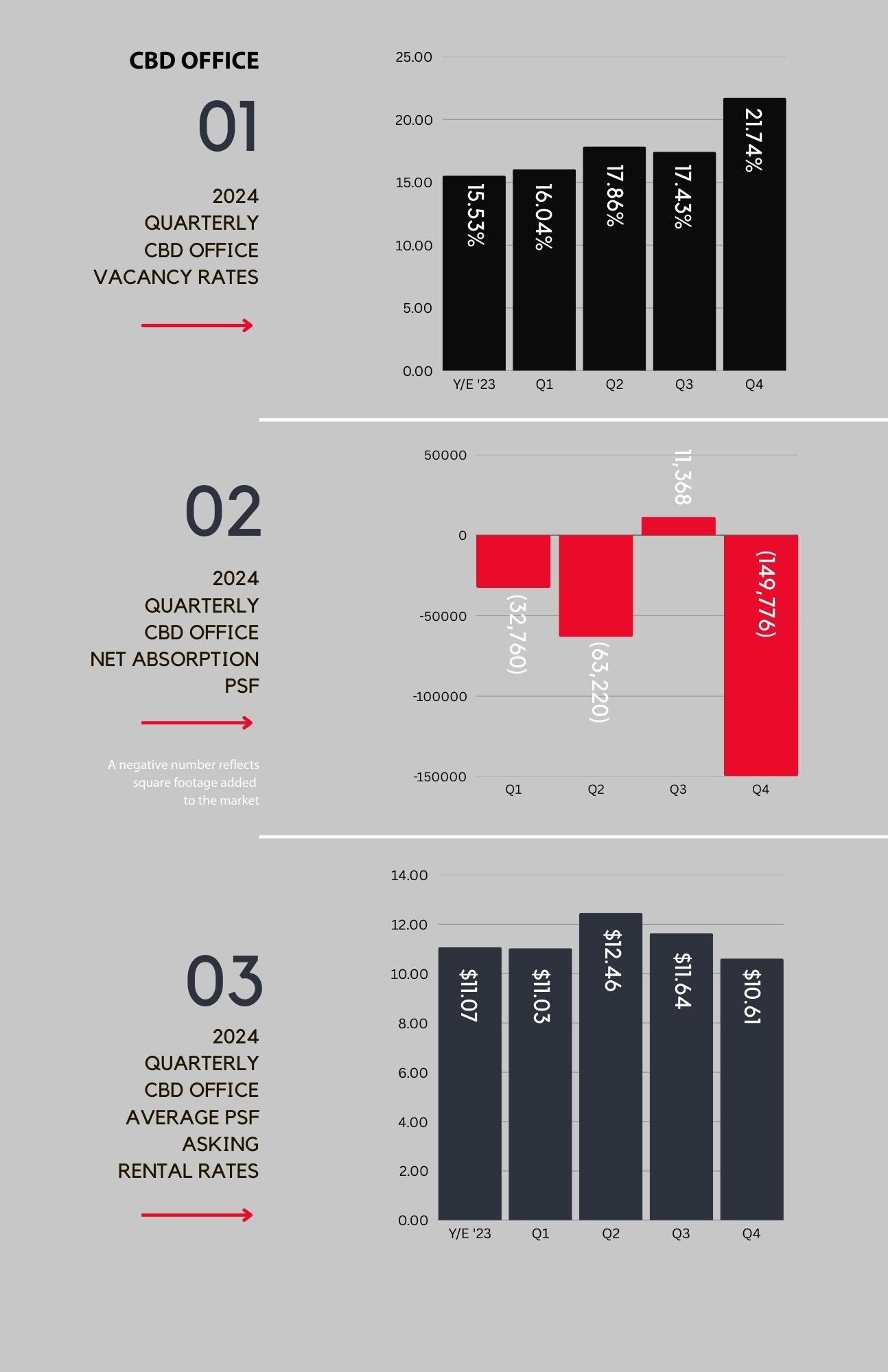

CENTRAL BUSINESS DISTRICT (CBD) OFFICE

Analysis

The figures contained herein focus on all CBD office buildings. Non-competitive hospital-owned properties, radio/television-occupied properties and existing buildings being converted to multifamily housing do not accurately affect local vacancy or rental rates and are therefore excluded from this analysis.

Market Overview

The CBD office market consists of approx. 3,500,000 square feet (SF). Entering 2024, the vacancy rate was 15.53% which ultimately increased to 21.74% by the end of the year. The average asking rental rate is $10.61/SF NNN, decreasing from $11.07/SF NNN at the beginning of 2024.

While the CBD lost Wells Fargo and Dubuque Bank & Trust’s retail banking operations, it gained the consolidated headquarters of both Foundation 2 Crisis Services (in the former Witwer building) and AbbeHealth Mental Health Services (in the former Stamats building).

Looking Ahead

Conversion of underutilized CBD office space to multifamily continued throughout 2024 and is expected to last through 2025.

Despite return-to-office mandates, not all employees are willing participants, meaning remote/hybrid work is here to stay. This will continue to keep the daytime population below pre-pandemic levels, adding to the challenges of CBD service establishments.

Significant transactions announced, in progress, completed or traded

- 221 2nd Avenue SE, Cedar Rapids — UI TIPPIE COLLEGE OF BUSINESS CR LEARNING CENTER — closed leaving a 12,000 SF vacancy of lecture hall and classroom space available for lease

- 600 3rd Avenue SE, Cedar Rapids — LUXE ON 3RD — the former Wellmark building was sold to a private investor for $2,266,000

- 500 3rd Avenue SE, Cedar Rapids — SHUTTLEWORTH & INGERSOLL — relocated from four floors of offices in their former US Bank location at 226 2nd Avenue SE

- 226 2nd Avenue SE, Cedar Rapids — FORMER US BANK — was announced as potential for redevelopment as a boutique hotel and upscale apartments

- 151 1st Avenue SW, Cedar Rapids — RYAN COMPANIES — leased 12,154 SF in Kingston Yard

- 123 5th Street SE, Cedar Rapids — PALMER BUILDING — 32,256 SF former ITC headquarters listed for sale or lease

- 150 1st Avenue NE, Cedar Rapids — WELLS FARGO — closed banking operations at this 43,418 SF branch and sold the building

- 615 5th Street SE, Cedar Rapids — ABBEHEALTH MENTAL HEALTH SERVICES — consolidated and relocated to the former 31,000 SF Stamats building

- 275 1st Avenue SW, Ste 204, Cedar Rapids — NYEMASTER GOODE — leased 4,387 SF in Kingston Yard

- 222 3rd Street SE, Cedar Rapids — FORMER GUARANTY BANK BLOCK — demolition and renovation began on commercial and multifamily space

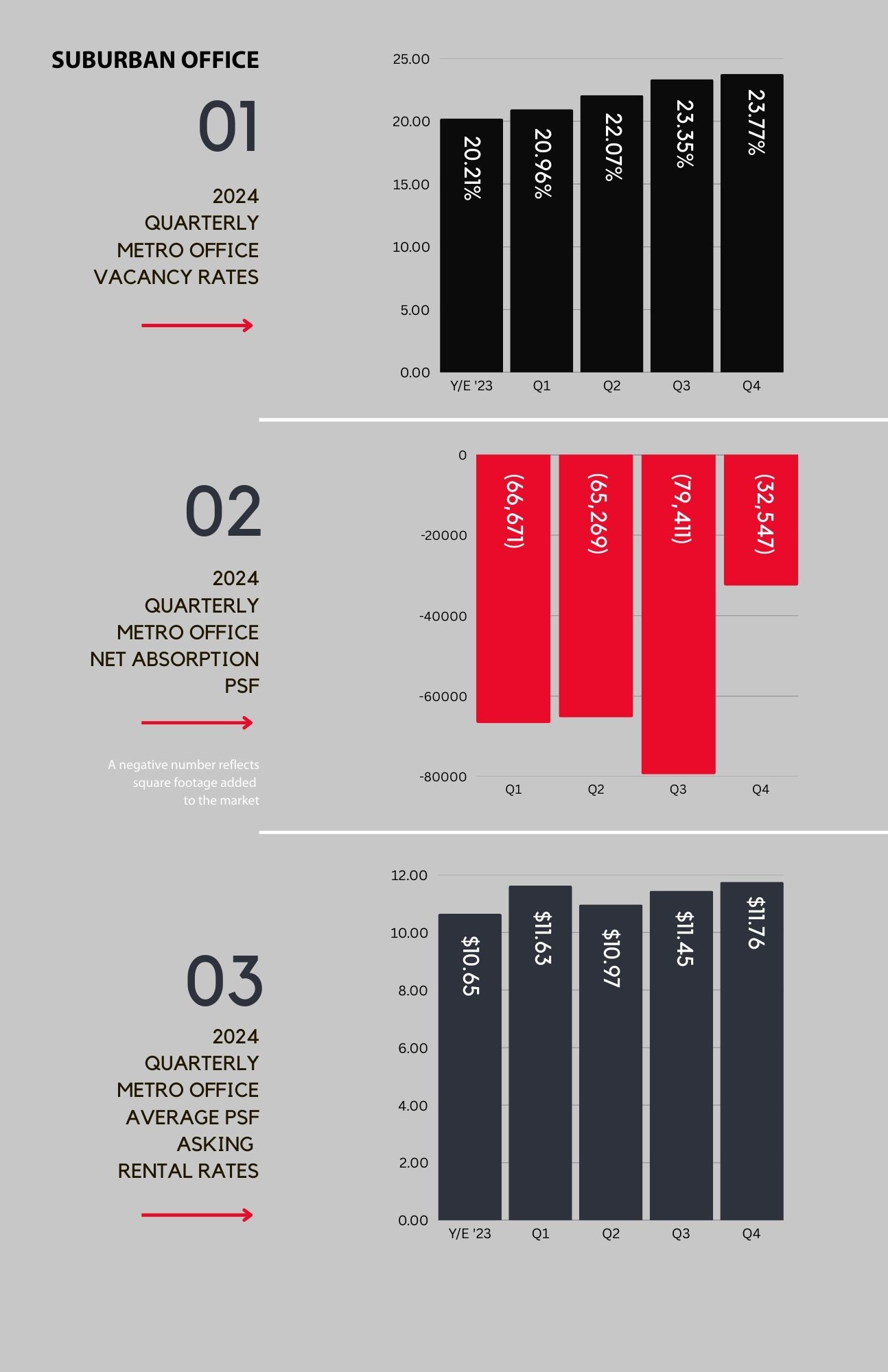

SUBURBAN OFFICE

Analysis

The figures contained herein focus on metro area office properties. CBD office and non-competitive owner-occupied medical buildings do not accurately affect local vacancy or rental rates and are therefore excluded from this analysis.

Market Overview

The Cedar Rapids metro suburban office market consists of approx. 5,800,000 SF. Entering 2024, the vacancy rate was 20.21% which increased throughout the year, finally ending at 23.77%. The average asking rental rate is $11.76/SF NNN, increasing from $10.65/SF NNN at the beginning of 2024.

The growing demand for healthcare services is driving vibrant expansion in the suburban office market with medical and dental offices leading the way. Steindler Orthopedic opened a 5,000 SF Cedar Rapids clinic while both Mercy and UnityPoint Hospitals opened free-standing emergency departments in Marion.

Interest rates and buying power have kept new construction starts slow/on hond. Higher vacancy in the suburban office market leads to greater scrutiny from lenders, meaning building owners may find it more difficult to finance tenant improvements or refinance their properties.

Looking Ahead

While net absorption faced challenges in 2024, the trend highlights a siginficant opportunity for property owners to modernize and enhance aging properties to meet the growing demand for amenities that attract today’s tenants.

Significant transactions announced, in progress, completed or traded

- 385 Collins Road NE, Cedar Rapids — FOUR OAKS — leased the 13,904 SF office building

- 1125 Dina Court, Ste. B, Hiawatha — CORDA CREDIT UNION — leased 9,002 SF of the former Safelite AutoGlass call center for their administrative operations and sponsored teacher store

- 4200 C Street SW, Ste. 2, Cedar Rapids — TRITON INC — leased the former 18,854 SF VSPEC office space

- 100 6th Avenue, Marion — IOWA KIDS PEDIATRIC DENTISTRY — completed building renovations and opened for business

- 929 Marthas Way, Hiawatha — FORMER TATA CONSULTANCY SERVICES — closed their call center adding 20,295 SF to the market for lease

- 4056 Glass Road NE, Cedar Rapids — THE WELLNESS COLLECTIVE — a private investor purchased this 6,161 SF office building for $700,000 and leased it to a therapy group

- 1450 Boyson Road, Ste. A, Hiawatha — MEDICAL CLINIC — purchased the 7,200 SF former Interior Perfection building for use as a medical office space

- 5250 N. River Boulevard NE, Cedar Rapids — OFFICE INVESTMENT — 37,016 SF office building, leased to Wabtec, was listed on the market for sale

- 4251 River Center Court NE, Cedar Rapids — IOWA WOMEN’S HEALTH CENTER — 7,029 SF building sold for use as a medical clinic