2024 Industrial real estate report

Analysis

The figures contained herein focus on existing, or currently under construction, industrial buildings including warehouse, flex, commercial and small shop properties. Non-competitive, owner-occupied, special-purpose manufacturing buildings do not accurately affect local vacancy or rental rates and are therefore excluded from this analysis.

Market Overview

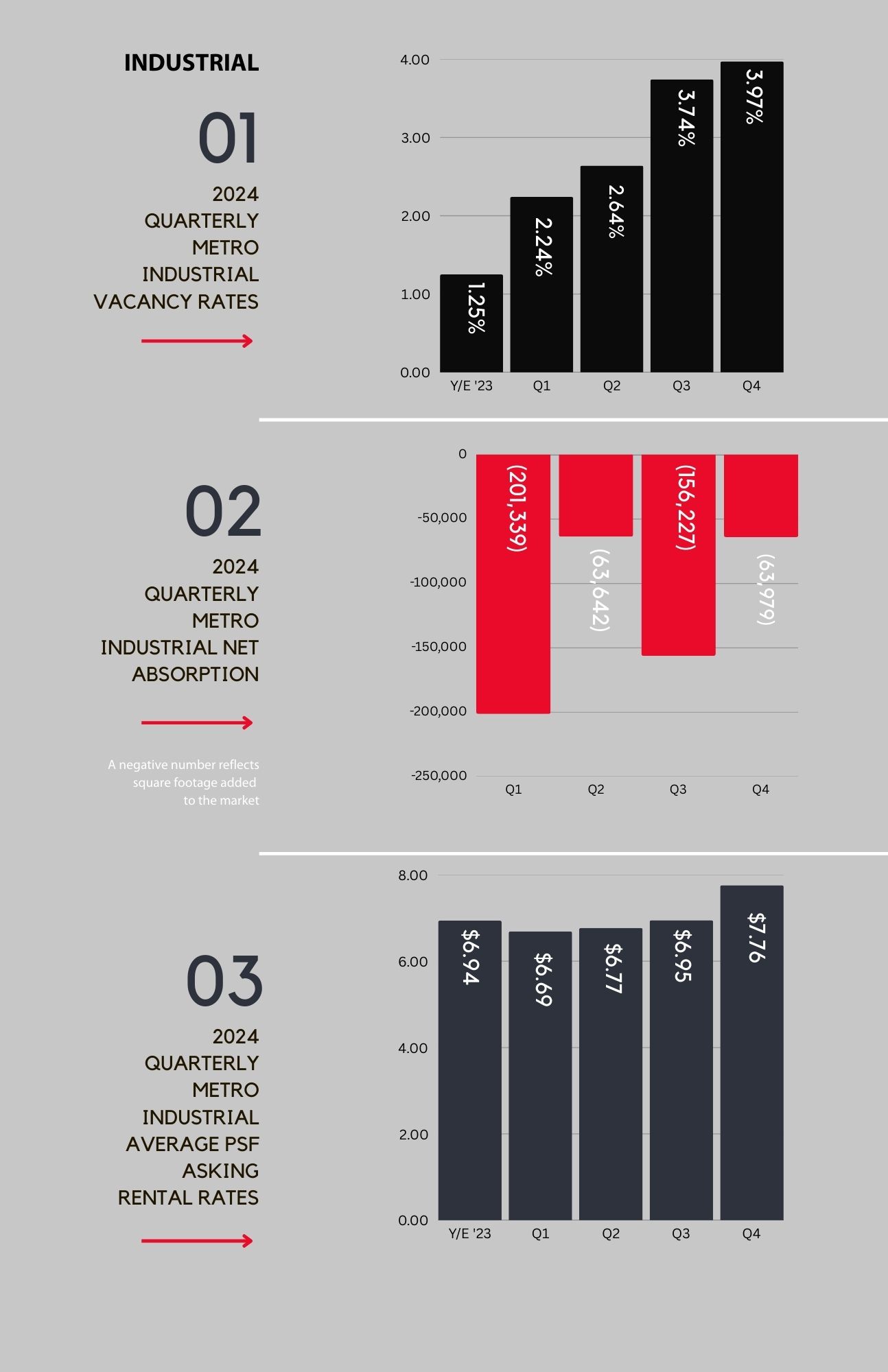

The Cedar Rapids industrial market consists of approx. 14,100,000 square feet (SF). Entering 2024, the vacancy rate was 1.25% which increased steadily throughout the year, ending at 3.97%. Much of this increase can be attributed to second and third generation space coming online.

The average asking rental rate is $7.76/SF NNN. This figure fluctuated slightly but eventually increased after beginning the year at $6.94/SF NNN. This increase is reflective of the continued increase of construction materials and financing costs.

With the introduction of artificial intelligence (AI), data center demand has risen exponentially. With its massive power demands, few sites can deliver on this requirement. Iowa’s first certified mega site, Big Cedar Industrial Park in Cedar Rapids, offers cost-effective land and utilities and has the potential for $1,326,000,000 investment from Google and QTS Data Centers in 2025.

Looking Ahead

Same- and next-day consumer goods delivery remains a popular option driving the continued demand for warehouse space. However, the large swings in space needs due to the pandemic seem to be behind us. New supply came online quicker than it could be absorbed resulting in the increase in availability.

Significant transactions announced, in progress, completed or traded

- 76th Avenue & Edgewood Road SW, Cedar Rapids — GOOGLE — $576,000,000 data center announced

- 1203 9th Street SW, Cedar Rapids — L & W SUPPLY — leased 36,048 SF of warehouse space

- 7708 6th Street SW, Cedar Rapids — MARTIN EQUIPMENT — constructing a new 21,500 SF facility

- 925 Boyson Court, Hiawatha — QUANTUM DIRECT SERVICES — purchased the 8,750 SF former CRAG Gymnastics building

- 76th Avenue & Edgewood Road SW, Cedar Rapids — QTS DATA CENTERS — $750,000,000 data center announced

- 3215 64th Avenue SW, Cedar Rapids — EDGEWOOD LOGISTICS PARK — 203,840 SF industrial building fully leased and added to the market for sale

- Wright Brothers Boulevard SW, Cedar Rapids — AIRPORT COMMERCIAL PARK — $21,000,000 industrial park on 15 acres with a total of 96,000 SF available for lease

- 8315 6th Street SW, Cedar Rapids — 380 COMMERCE PARK — 60,000 SF speculative building constructed and partially leased to Workspace/Storey Kenworthy and Kline Electric